ATAD2 reporting

VanOlde developed an all-covering ATAD2 software model to generate fully compliant ATAD2 reports at a low cost and with little effort.

Reporting obligation

As of 1 January 2020, the Dutch implementation of the EU Anti-Tax Avoidance Directive (ATAD2) entered into force. Each Dutch taxpayer must include and substantiate in its administration to what extent the ATAD2 anti-hybrid legislation applies.

Complying with the reporting obligation can be a time-consuming and complicated exercise, especially for structures that involve various countries. Factual, legal, and tax input is needed from each jurisdiction involved, for potentially many different ATAD2 hybrid mismatches.

Solution

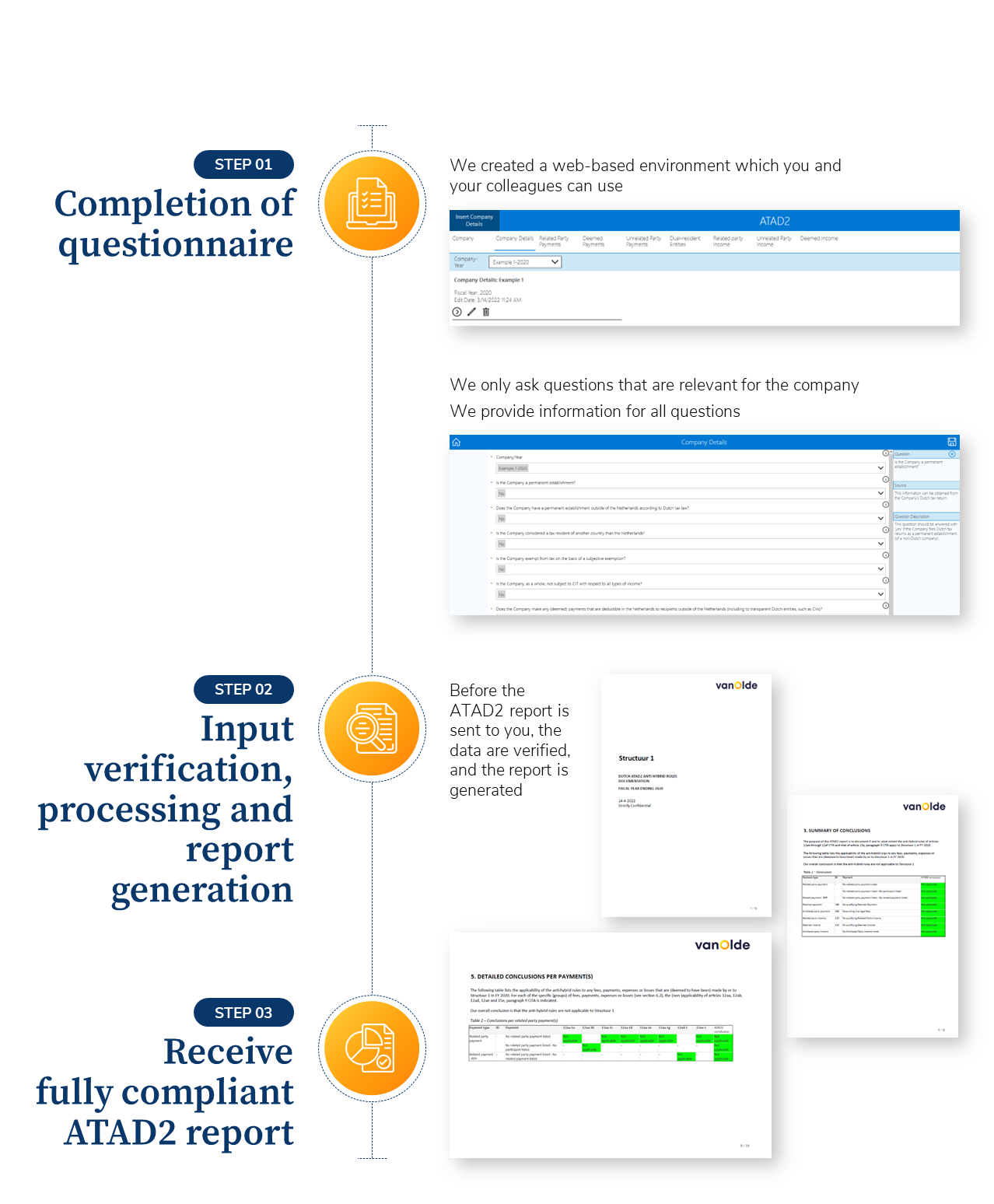

The three-step automatic reporting model consists of: (step 1) the completion of a questionnaire, (step 2) the verification of the provided input, processing of the input and generating a report and (step 3) receiving a fully compliant ATAD2 report.

Through our automated ATAD2 reporting model, we can offer ATAD2 compliance at a lower cost while significantly less input from the taxpayer is required.

Please contact Hans van Walsem or Gerard van der Linden for more information.